🟢 $BTCN, a.k.a. "Bitcorn"

Bitcoin is the most universally recognized digital asset and the most trust-minimized form of money, prized for its decentralization, predictable supply, and global neutrality -- but its utility has been mostly been limited to holding. $BTCN changes this, extending Bitcoin’s utility by making it the gas token of Corn, unlocking its potential to fuel DeFi applications while preserving its security and liquidity.

What is $BTCN?

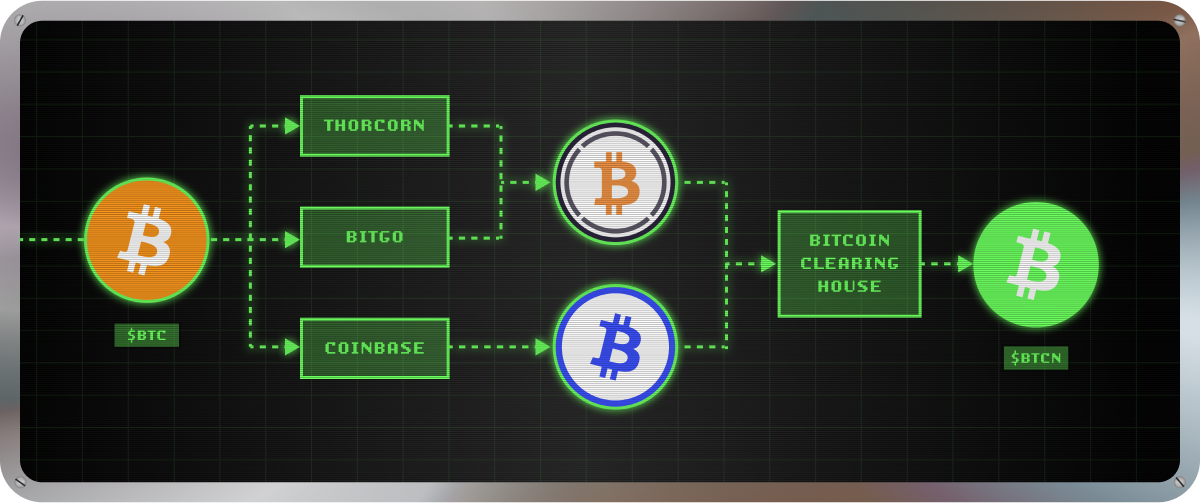

$BTCN is a hybrid tokenized Bitcoin backed 1:1 by native BTC. What do we mean by hybrid? This refers to the capacity for $BTCN to be collateralized by multiple Bitcoin-backed collateral types and for the native BTC collateral that ultimately backs $BTCN to be held by multiple custodians. The asset will start by being collateralized by $cbBTC and $wBTC (with custody provided by Coinbase and BitGo — two of the industry’s most trusted custodians), with the opportunity of expanding this list over time through a rigorous risk-managed, secure, and transparent process led by Corn's Risk Council.

The Bitcoin Clearing House, a smart contract on Ethereum Mainnet, governs $BTCN’s minting and is the first counterparty to receive $BTCN minting rights. The Bitcoin Clearing House ensures that every $BTCN token is transparently backed by trusted assets, maintaining the stability and integrity of the asset, and in-turn, the Corn Network. Its flexible design anticipates the future of decentralized storage solutions and bridging protocols, ensuring $BTCN can grow and adapt alongside them.

Unlocking New Bitcoin-Centric Applications

With $BTCN at the core of Corn, Bitcoin can now be leveraged across a wide range of DeFi applications. Builders on Corn can create more optimized, Bitcoin-focused financial applications, which unlock capital efficiency, better lending protocols, and enhanced AMMs that incorporate Bitcoin directly into their mechanisms. This makes Corn the best place to build innovative, fun, and highly efficient products centered around Bitcoin.

The Bitcoin Clearing House

The Bitcoin Clearing House is a smart contract on Ethereum Mainnet that facilitates the minting and redemption of $BTCN at a fixed 1:1 ratio. Modeled after MakerDAO’s Peg Stabilization Module (PSM), it currently only accepts $cbBTC and $wBTC as collateral to ensure high liquidity and security.

All swaps are fee-free, have zero slippage, and no size limits. The smart contract holds reserves transparently, serving as proof of backing for $BTCN. Minted $BTCN can be bridged to Corn via LayerZero.

A Risk Management Council governs collateral policies, including asset whitelisting and redemption rules. Over time, the system may expand to include additional Bitcoin-backed assets and introduce yield-bearing reserves while maintaining security and stability. Arbitrage opportunities created by the Clearing House help ensure efficient pricing across the Corn ecosystem.

Acquiring and Bridging

Corn will have two major on/off ramps for moving Bitcoin into and out of the Corn ecosystem – and $BTCN will play a critical function in each.

- LayerZero Bridge: Bridging $cbBTC or $wBTC from any supported blockchain through Corn's canonical bridge allows users to easily acquire $BTCN. This bridge is currently available. Average gas costs on Corn are very low, so sending $10 - $20 equivalent of one of these BTC-backed assets will be sufficient for many transactions on Corn. Once you have an active wallet and at least a small amount of $BTCN, you can acquire more by swapping other assets on any of the available decentralized exchanges (DEXs) that support $BTCN.

- BlueCorn (via Coinbase): Built atop Coinbase's $cbBTC, this bridge will enable Coinbase users to seamlessly convert their native Bitcoin into $BTCN by tranferring directly to Corn. This bridge is not currently available.

Check out the following user guides for each one of the above paths.

Why Bring Bitcoin to the EVM?

Bitcoin is powerful but limited in terms of programmability. By tokenizing Bitcoin on Corn, BTCN brings Bitcoin into the Ethereum Virtual Machine (EVM), where it can be utilized in smart contracts, DeFi protocols, and dApps.

Wrapped Bitcorn (wBTCN)

Similar to ETH with wETH on Ethereum, BTCN can be further wrapped into Wrapped Bitcorn (wBTCN) on Corn to enhance interoperability with DeFi protocols that require ERC-20 tokens.

Learn more about wBTCN and how to wrap BTCN here.

The Bitcoin Liquidity Cycle

By positioning Bitcoin as the gas token with $BTCN, Corn incentivizes Bitcoin holders to bring Bitcoin-backed liquidity onto the network. This increased flow of Bitcoin-backed assets strengthens DeFi applications by making Bitcoin the deepest liquidity and most common trading pair on Corn.

Bitcoin’s status as the most widely held and trusted crypto asset lowers the barrier to entry for users. Continuous yield in $BTCN and $CORN serves as an incentive for engagement and adoption across the network.

$BTCN ensures that Bitcoin hodlers aren't limited to passive accumulation—they can actively participate in a network designed around Bitcoin while remaining exposed to this asset's growth.